TL; Defalcare DR

- Polkadot price analysis suggests upwards movement to the $6.60 resistance again

- Cel mai apropiat nivel de asistență se află la 6.400 USD

- DOT se confruntă cu rezistență la valoarea de 6.727 USD

Buline price analysis shows that the DOT price action has fallen below the $6.500 level, but the bulls find short-term support at $6.400 mark.

Piața mai largă a criptomonedelor a observat un sentiment de piață de urs în ultimele 24 de ore, deoarece majoritatea criptomonedelor importante au înregistrat mișcări negative ale prețurilor. Jucătorii importanți includ NEAR și AVAX, înregistrând o scădere de 6.97, respectiv 6.09%.

Analiza prețului Polkadot: DOT scade sub 6.500 USD

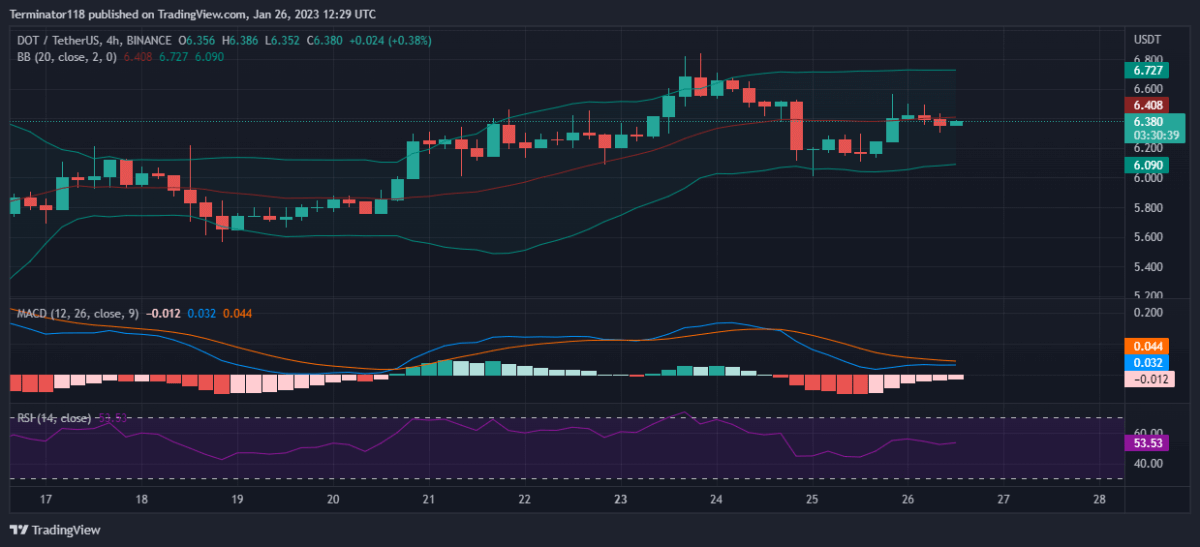

The MACD is currently bearish, as expressed in the red colour of the histogram. However, the indicator shows low bearish momentum as expressed in the short depth of the indicator. Moreover, the lighter shade of the histogram shows a declining bearish pressure as the price finds support at the $6.400 mark.

The EMAs are currently trading above the mean position as net price movement over the last ten days remains positive. Currently, the EMAs are trading close to each other showing low momentum at press time. Moreover, the converging EMAs suggest a decreasing bearish pressure for the asset.

The RSI briefly rose to the overbought region but has since gone down toward the mean line as the bullish momentum slowed down. At press time, the indicator has retreated to the mean line at the 53.53 index unit level showing low net momentum. Moreover, the horizontal price action shows low activity in the markets in recent hours.

The Bollinger Bands are currently narrow as the price action exhibits low volatility in recent days. However, the indicator is converging as the price action observes low volatility near the mean line of the indicator. The indicator’s bottom line provides support at the $6.090 mark while the bottom line presents a resistance level at the $6.727 mark.

Analize tehnice pentru DOT/USDT

Per total, cele 4 ore Pretul Polkadot analysis issues a buy signal, with 12 of the 26 major technical indicators supporting the bulls. On the other hand, four of the indicators support the bears showing low bearish presence in recent hours. At the same time, nine indicators sit on the fence and support neither side of the market.

The 24-hour Polkadot price analysis does not share this sentiment and instead issues a buy signal with 14 indicators suggesting an upwards movement against four suggesting a downward movement. The analysis shows strong bullish dominance across the mid-term charts with little bearish resistance persisting. Meanwhile, the remaining ten indicators remain neutral and do not issue any signals at press time.

La ce să vă așteptați de la analiza prețurilor Polkadot?

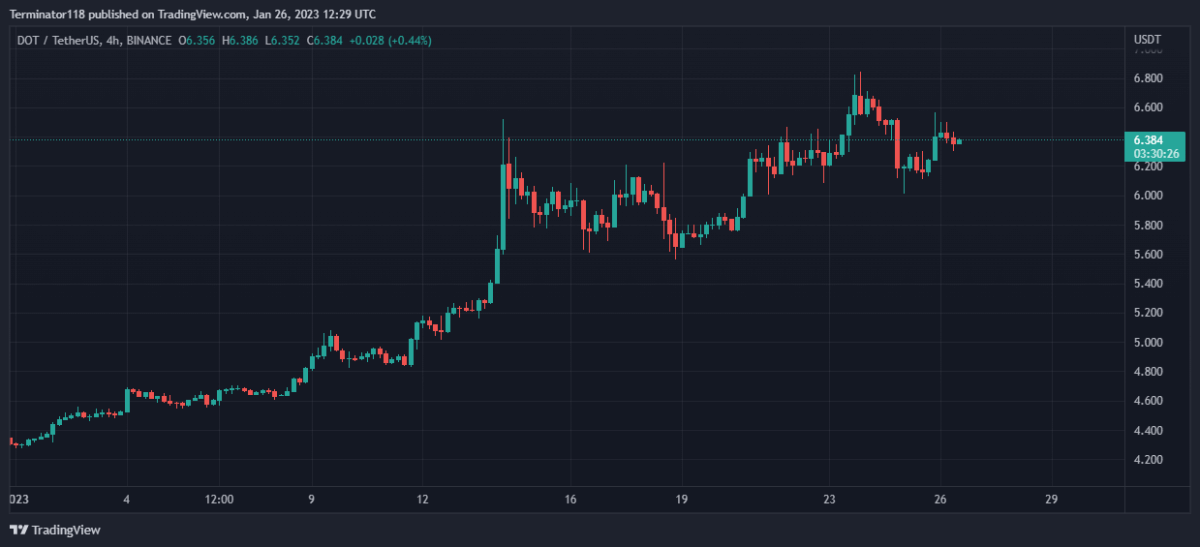

The Polkadot price analysis shows that the Polkadot market is enjoying a strong bullish rally as the price rose from $4.300 to the current $6.500 in the last 30 days. Currently, the price is facing strong bearish pressure at this level as the price action was rejected at the $6.800 mark and falls back toward the $6.400 mark.

Traders should expect DOT to find strong support at the $6.400 mark as the bearish pressure subsides. While the short-term technicals are bearish, they show a declining bearish momentum as the bulls take back the reins. The suggestion is reinforced by the bullish mid-term analyses, that suggest upwards movement to the $6.80 mark as the bulls make another attempt to climb to the $7.00 level.

Sursă: https://www.cryptopolitan.com/polkadot-price-analysis-2023-01-26/