This post was originally publihed onn TKer.co

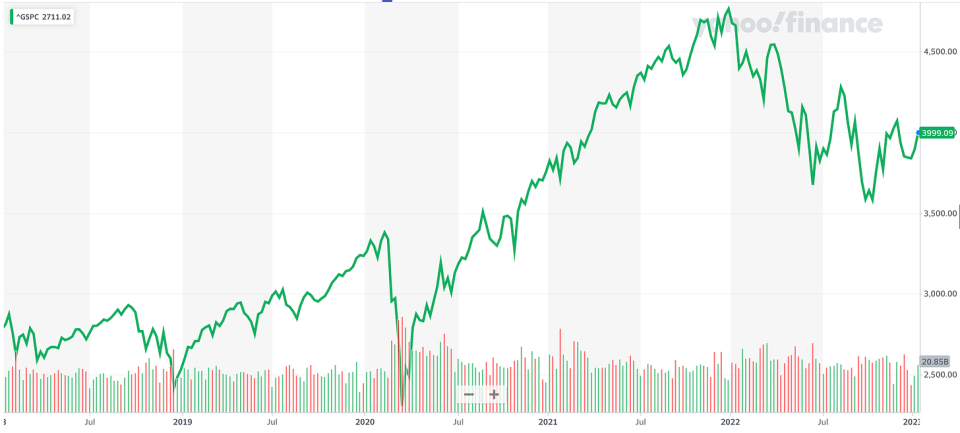

Stocks rallied again, with the S&P 500 climbing 2.7% last week. The index is now up 11.8% from its October 12 closing low of 3,577.03 and down 16.6% from its January 3, 2022 closing high of 4,796.56.

The past two weeks have come with loads of new data, and a lot of analysts returning from break published tons of fresh research.

Here are a few charts about the market that stood out:

Financial obligations have been manageable

“To date, higher interest rates have not negatively impacted margins,” Jonathan Golub, chief U.S. equity strategist at Credit Suisse, wrote in a January 4 note to clients.

To illustrate this, Golub share this chart of S&P 500 interest expenses as percentage of revenue.

For more on the implications of higher interest rates, read “There’s more to the story than ‘high interest rates are bad for stocks’ 🤨,“ “Business finances look great 💰,“ and “De ce să rambursați 500 USD poate fi mai greu decât să rambursați 1,000 USD 🤔“

Companies are investing in their business

“Despite macro uncertainty, capex spending has remained strong, accelerating to +24% YoY in 3Q, driven by Energy and Communication Services,“ Savita Subramanian, head of U.S. equity strategy at BofA, observed on Friday.

BofA expects the U.S. economy to go into recession în acest an.

“Although capex is typically pro-cyclical, we see several reasons that capex will be more resilient during this recession than in the past, including persistent supply challenges, the need to spend on automation amid wage inflation/tight labor market, reshoring, underinvestment by corporates for decades, and the energy transition.“

For more on capex spending, read “9 motive pentru a fi optimist cu privire la economie și piețe 💪“ and “Trei vânturi economice masive la care nu mă pot opri să mă gândesc 📈📈📈.“

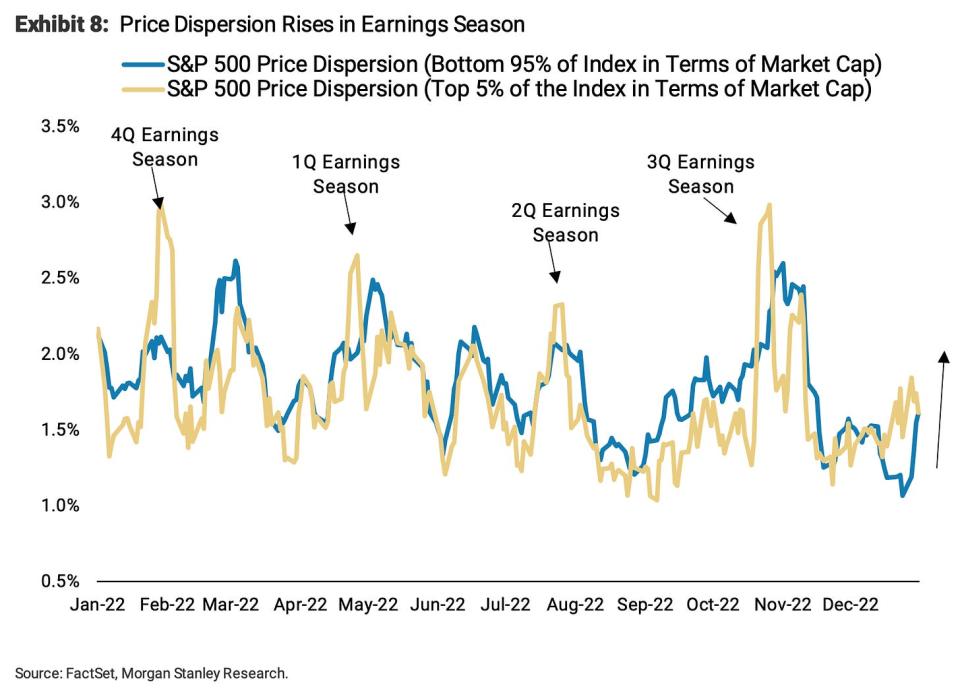

Watch for stocks to decouple during earnings season

“We look for price dispersion to rise over the next ~6 weeks as it has done throughout prior earnings seasons,” Mike Wilson, chief U.S. equity strategist at Morgan Stanley, wrote on Monday.

Dispersion reflects the degree to which individual stocks move together.

While Subramanian believes capex spending will hold up, Wilson argues that companies cutting back will be see their stock prices outperform.

“In our view, a key driver of this pick up in dispersion will be the widening relative performance gap between those companies that are operationally efficient in this challenging macro environment and those that are not,” he said. “In this sense, we think companies that minimize capex, inventory and labor investment and maximize cash flow will be rewarded on a relative basis.”

Subscris

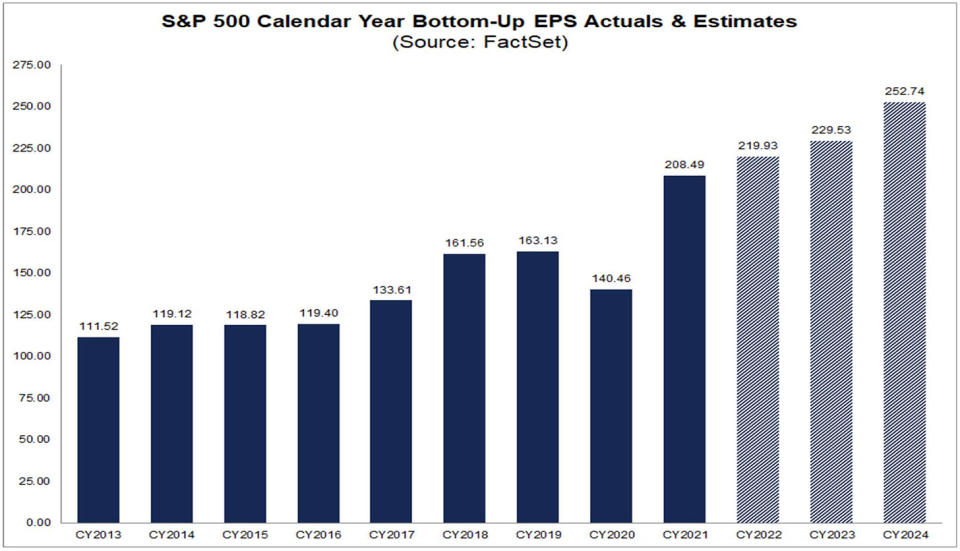

Analysts expect earnings growth in 2023 and 2024

În conformitate cu FactSet, analysts are expecting S&P 500 earnings per share (EPS) to rise to $229.53 in 2023 and $252.74 in 2024.

For more bullish metrics, read “9 motive pentru a fi optimist cu privire la economie și piețe 💪.“

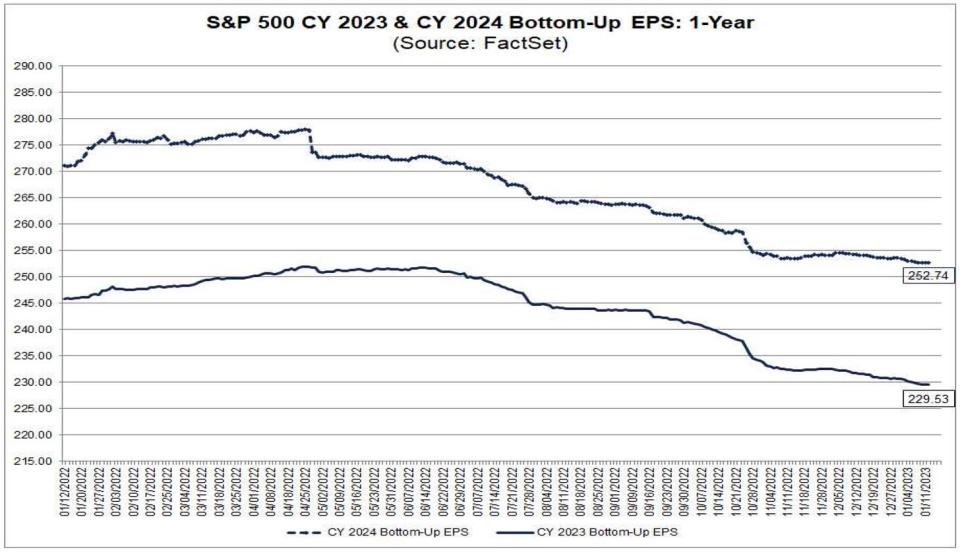

However, those expectations have been coming down

De la FactSet:

There’s no shortage of strategists expecting these numbers to be revised lower. For more, read “Unul dintre cele mai frecvent citate riscuri pentru acțiuni în 2023 este „supraestimat” 😑.“

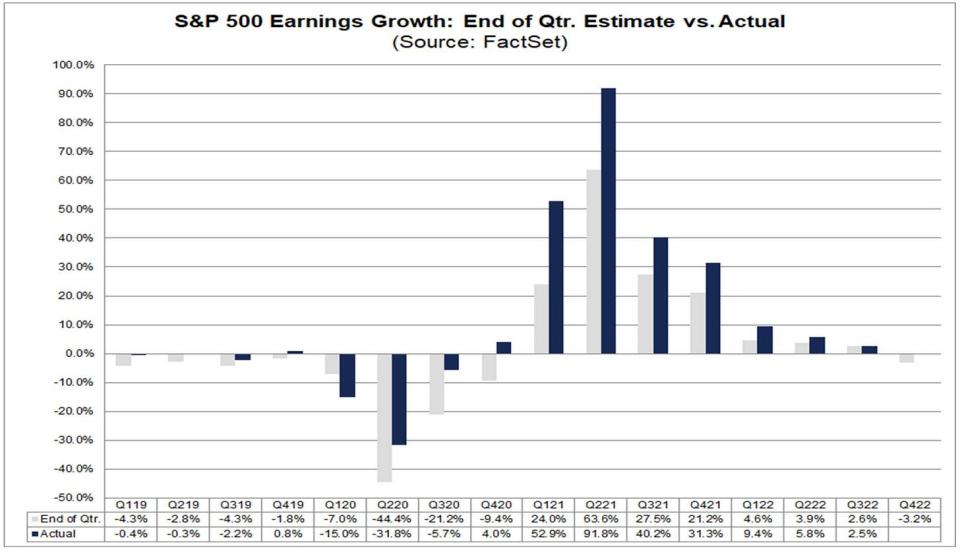

Earnings growth usually beats estimates

De la FactSet: “…the actual earnings growth rate has exceeded the estimated earnings growth rate at the end of the quarter in 38 of the past 40 quarters for the S&P 500. The only exceptions were Q1 2020 and last quarter (Q3 2022).”

For more on this, read “„Mai bine decât se aștepta” și-a pierdut sensul 🤷🏻♂️“ and “Adevărul despre așteptările în deteriorări ale analiștilor 📉.“

Valuations bottom before expected earnings

“In prior bear markets, equities have troughed ~1m before the ISM bottoms, but 1-2 months after financial conditions peak,” Keith Parker, head of U.S. equity strategy at UBS, wrote in a January 4 note. “The market bottom coincides with the P/E bottom in almost all instances, with a rise in the P/E typically following a fall in corporate bond yields.“

The chart below shows the P/E bottom also precedes the bottom in forward earnings estimates.

For more on P/E ratios, read “Use valuation metrics like the P/E ratio with caution ⚠️.“ For more on stocks bottoming, read “Stocks usually bottom before everything else. "

In the long run, earnings go up

Deutsche Bank’s Binky Chadha expects Q4 earnings of $53.80 per share for the S&P 500. This would bring EPS closer to its long-run trend, which is up and to the right.

For more on long-term earnings, read “Expectations for S&P 500 earnings are slipping 📉“ and “Legendarul selector de acțiuni Peter Lynch a făcut o observație remarcabil de prevăzătoare a pieței în 1994 🎯.“

Great years follow horrible years

“In the past 90 years, the S&P 500 has only posted a more severe loss than its 19.4% annual decline in 2022 on four occasions – 1937, 1974, 2002, and 2008,” Brian Belski, chief investment strategist at BMO Capital Markets, observed on Thursday. “In the subsequent calendar years, the index logged >20% gains each time with an average price return of 26.5% as highlighted in Exhibit 8.“

For more on short-term patterns in the stock market, read “2022 a fost un an neobișnuit pentru bursă 📉“ and “Don’t expect average returns in the stock market this year 📊“

Subscris

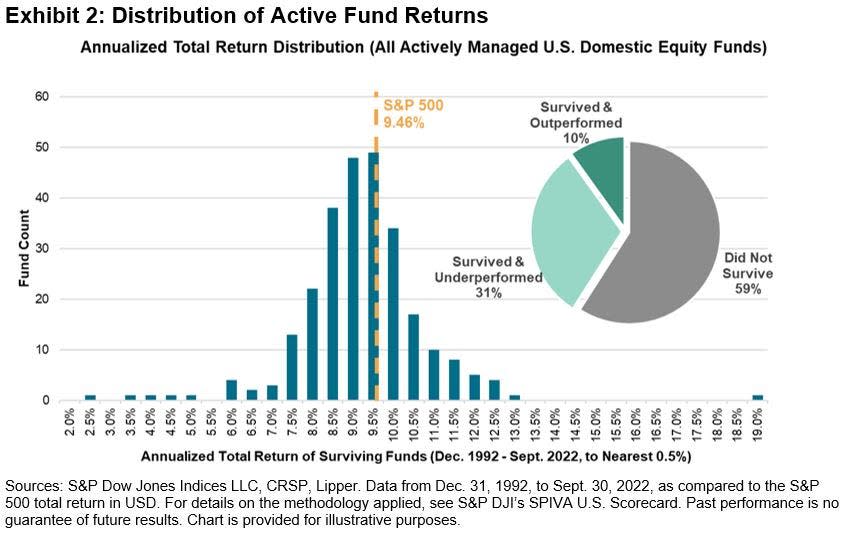

Not many ETFs beat the S&P 500

De la Indicii S&P Dow Jones: “On Jan. 29, 2023, the world’s longest-surviving exchange-traded fund — initially known as the Standard & Poor’s Depository Receipt or by the acronym SPDR (the “Spider”) — will celebrate 30 years since it began trading… Investing in an index tracker was seen (by some) as an admission of defeat back in early 1993. At best, an index fund was “settling for average.” But, as it turns out, a portfolio approximately replicating the S&P 500’s return would have been emphatically above average since then.”

For more on this, read “Most pros can’t beat the market 🥊“

Most consumers expect stocks to fall

De la NY Fed’s Survey of Consumer Expectations: “The mean perceived probability that U.S. stock prices will be higher 12 months from now decreased by 0.8 percentage point to 34.9%.“

For more on this, read “Most of us are terrible stock market forecasters 🤦♂️.“

BONUS: Execs are talking sh*t on earnings calls

De la FT’s Robin Wigglesworth: “Using AlphaSense/Sentieo’s transcription search function, we can see that the ‘polycrisis’ of runaway inflation, pandemics, interest rate increases, supply chain snafus and wars helped lift swearing on earnings calls and investor days to a new record high in 2022. Sadly, when we first looked into this last year it turned out that most of the redacted swear words were pretty plain vanilla, like ‘shit’ and ‘bullshit.’“

It’s a lot to process. Indeed, investing in the stock market can be complicated.

Overall, there seem to be a lot of reasons to be optimistic. And the reasons to be pessimistic aren’t particularly out of the ordinary.

For many more charts on the stock market, read “2022 a fost un an neobișnuit pentru bursă 📉.“

-

Relat de la TKer:

Revizuirea macrocurenților încrucișați 🔀

Au fost câteva date notabile de săptămâna trecută de luat în considerare:

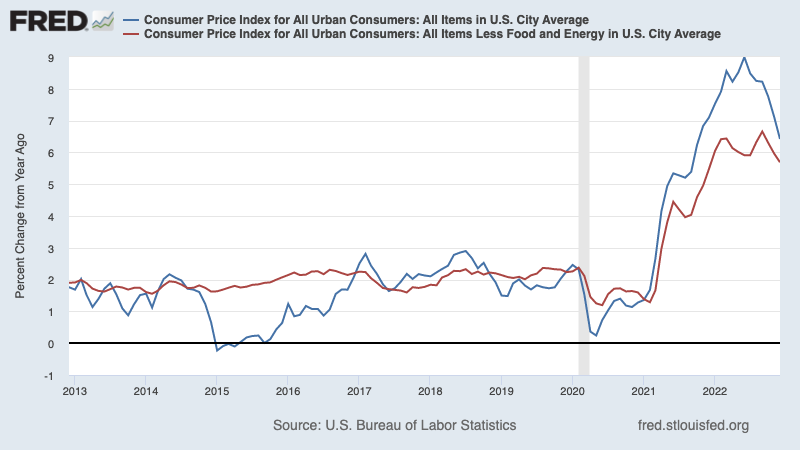

🎈 Inflația continuă să se răcească. indicele prețurilor de consum (CPI) in December was up 6.5% from a year ago, down from 7.1% in November. Adjusted for food and energy prices, core CPI was up 5.7%, down from 6.0%.

On a month-over-month basis, CPI was down 0.1% and core CPI was up 0.3%.

If you annualized the three-month trend in the monthly figures, CPI is rising at a cool 1.8% rate and core CPI is climbing at a just-above-target 3.1% rate.

For more on the implications of cooling inflation, read “Scenariul optimist de aterizare soft „bucni de aur” pe care și-l dorește toată lumea 😀.“

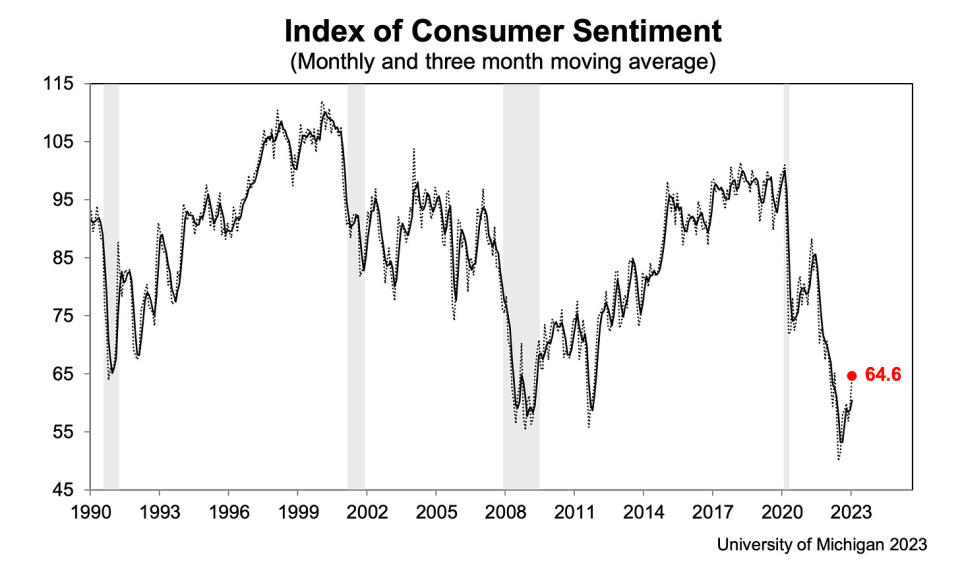

???? Consumer sentiment improves. De la Universitatea din Michigan, decembrie Sondajul consumatorilor: “Consumer sentiment remained low from a historical perspective but continued lifting for the second consecutive month, rising 8% above December and reaching about 4% below a year ago. Current assessments of personal finances surged 16% to its highest reading in eight months on the basis of higher incomes and easing inflation… Year-ahead inflation expectations receded for the fourth straight month, falling to 4.0% in January from 4.4% in December. The current reading is the lowest since April 2021 but remains well above the 2.3-3.0% range seen in the two years prior to the pandemic.“

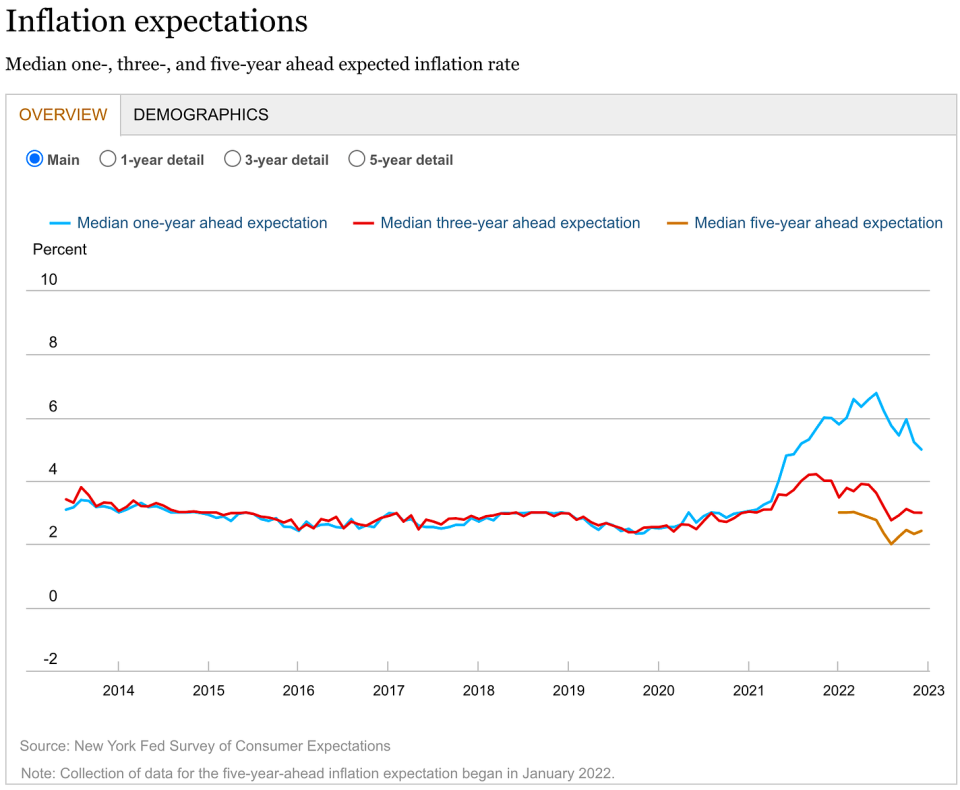

???? Expectations for inflation improve. From the NY Fed’s December Survey of Consumer Expectations: “Median one-year-ahead inflation expectations declined to 5.0%, its lowest reading since July 2021, according to the December Survey of Consumer Expectations. Medium-term expectations remained at 3.0%, while the five-year-ahead measure increased to 2.4%.“

💳 Consumatorii își asumă mai multe datorii. Conform Datele Rezervei Federale released Monday, total revolving consumer credit outstanding increased to $1.19 trillion in November. Revolving credit consists Mai ales a împrumuturilor cu cardul de credit.

💳 Credit card interest rates are up. din Axios: “The Federal Reserve’s most recent report on costs of consumer credit showed average interest rates on bank-issued credit cards touching 19.1% in the fourth quarter. That beats the previous record high — 18.9% — set in the first quarter of 1985.“

💳 Credit card delinquencies are low, but normalizing. From JPMorgan Chase’s Q4 earnings announcement: “We expect continued normalization in credit in 2023.“ The bank’s outlook assumes a “mild recession in the central case.“ For more on this, read “Finanțele consumatorilor sunt într-o formă remarcabil de bună 💰“

???? Overall consumer finances are stable. From Apollo Global Management’s Torsten Slok: “…households across the income distribution continue to have a higher level of cash available than before the pandemic, and the speed with which households are running down their cash balances in recent quarters has been very slow. Combined with continued solid job growth and robust wage inflation, the bottom line is that there remains a powerful tailwind in place for US consumer spending.“

“The U.S. economy currently remains strong with consumers still spending excess cash and businesses healthy,” Jamie Dimon, CEO of JPMorgan Chase, a spus on Friday. For more on this, read “Finanțele consumatorilor sunt într-o formă remarcabil de bună 💰“

🛍️ Consumer spending is stable. From BofA: “Although upper-income (<125k) spending modestly outperformed lower-income (<50k) spending during the holidays, we see no clear signs of cracks in the latter. Lower-income HHs are still allocating a larger share of total card spending to discretionary categories than they were before the pandemic (Exhibit 7). This suggests they are not yet moving to a more precautionary stance. Lower-income HHs also do not yet appear to be facing liquidity issues, since they are allocating a smaller share of total card spending to credit cards than they did in 2019 (Exhibit 8).“ For more economic indicators that are holding up, read “9 motive pentru a fi optimist cu privire la economie și piețe 💪.“

💼 Cererile de șomaj rămân scăzute. Cereri inițiale pentru indemnizație de șomaj fell to 205,000 during the week ending Jan. 7, down from 206,000 the week prior. While the number is up from its six-decade low of 166,000 in March, it remains near levels seen during periods of economic expansion.

🤒 Many are out sick. din KPMG’s Diane Swonk: “Nearly 70% more workers out sick each month than pre-pandemic average. The scars of the pandemic are adding to staffing shortages. The number of those out sick and unable to work hit 1.6 million in November; that left nearly 700,000 more people on the sidelines than in any month of the 2010s. Fatalities to date are higher than other developed economies. Many older workers had COVID and are unable to work due to long COVID. Younger retirees are now needed to care for grandchildren and elderly parents, due to acute shortage of child and long-term care workers. Those out from work due to childcare problems reached an all-time high in October as more children were sick with RSV, Flu, and COVID-19.“

💼 Job openings are ticking lower. From labor market data firm Conecta: “…labor demand continued to decline through the end of 2022 as total active job listings dropped 4.5% in the U.S. from November to December, compared to the 6.9% decrease in listing volume from October to November, and declined across nearly all states and industries as well. Employers also created fewer listings in December, as the count of new job listings dropped 3.2% month-over-month. However, while we observed declines in both new and total listings, removed listings grew by 3.5% from November to December.“ For more on this, read “How job openings explain everything right now 📋“

📈 Nivelurile de inventar sunt în creștere. Conform Datele Biroului de recensământ released Tuesday, wholesale inventories climbed 1.0% to $933.1 billion in November, bringing the inventories/sales ratio to 1.35. For more, read “Putem înceta să numim asta o criză a lanțului de aprovizionare ⛓.”

Punând totul împreună 🤔

Primim o mulțime de dovezi că am putea obține scenariul de aterizare ușoară „Buc de aur” optimist unde inflația se răcește la niveluri gestionabile fără ca economia să fie nevoită să se scufunde în recesiune.

Dar pentru moment, inflația trebuie să scadă mai mult înainte ca Rezerva Federală să se simtă confortabilă cu nivelurile prețurilor. Deci ar trebui să ne așteptăm la banca centrală să continue înăsprirea politicii monetare, ceea ce înseamnă condiții financiare mai stricte (de exemplu, rate mai mari ale dobânzii, standarde mai stricte de creditare și evaluări mai mici ale acțiunilor). Toate acestea înseamnă este probabil ca bătăile pieței să continue iar riscul economia se scufundă într-o recesiune se va intensifica.

However, we may soon hear the Fed change its tone in a more dovish way if we continue to get evidence that inflation is easing.

Este important să ne amintim că, în timp ce riscurile de recesiune sunt crescute, consumatorii provin dintr-o poziție financiară foarte puternică. Șomerii sunt obtinerea de locuri de munca. Cei cu locuri de muncă primesc mariri de salariu. Și mulți încă mai au economii în exces sa acceseze. Într-adevăr, datele solide privind cheltuielile confirmă această rezistență financiară. Deci este prea devreme pentru a suna alarma din perspectiva consumului.

În acest moment, orice este puțin probabil ca recesiunea să se transforme în calamitate economică dat fiind că sănătatea financiară a consumatorilor și a întreprinderilor rămâne foarte puternică.

Ca întotdeauna, investitorii pe termen lung ar trebui să-și amintească asta recesiunilor și piețele de urs sunt doar parte din afacere atunci când intri pe bursa cu scopul de a genera randamente pe termen lung. In timp ce piețele au avut un an groaznic, perspectiva pe termen lung pentru acțiuni rămâne pozitiv.

Pentru mai multe despre cum evoluează povestea macro, consultați macrocurentele anterioare TKer »

Pentru mai multe despre motivul pentru care acesta este un mediu neobișnuit de nefavorabil pentru piața de valori, citiți „Bataile pietei vor continua pana cand inflatia se va imbunatati 🥊„ »

Pentru o privire mai atentă asupra unde suntem și cum am ajuns aici, citiți „Mizeria complicată a piețelor și a economiei, a explicat 🧩Matei 22:21

This post was originally publihed onn TKer.co

Sam Ro este fondatorul TKer.co. Urmărește-l pe Twitter la adresa @SamRo

Source: https://finance.yahoo.com/news/some-stock-market-charts-to-consider-as-we-look-forward-171700592.html