Here are 3 companies under large accumulation this year.

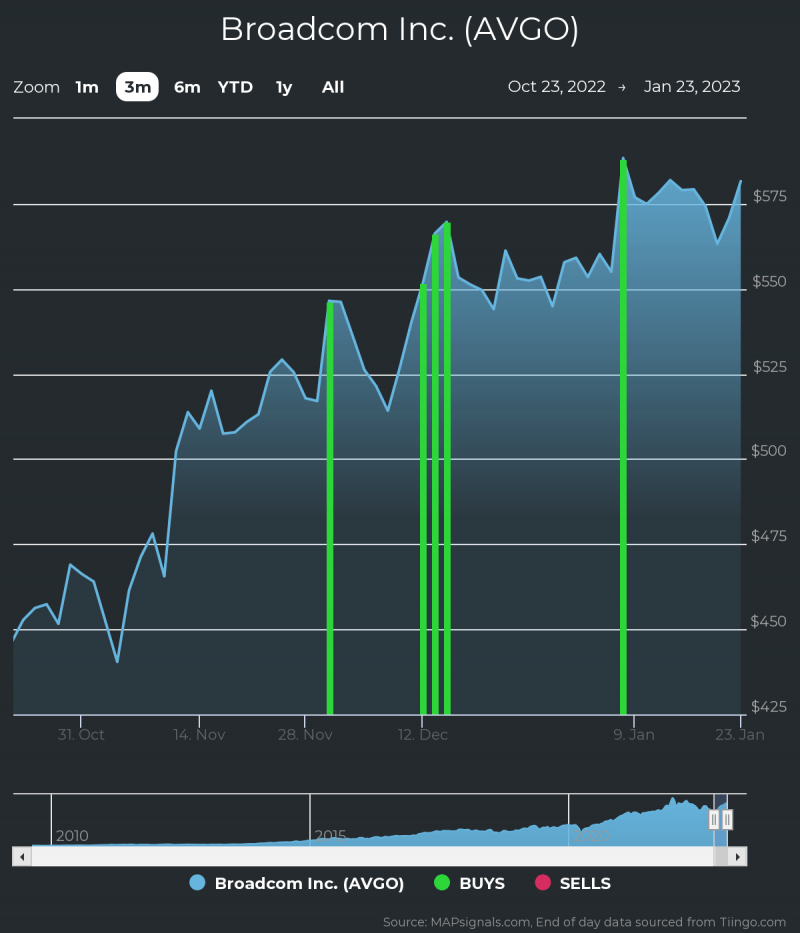

Broadcom Inc. (AVGO) Analysis

Primul este Broadcom (AVGO) which is a large semiconductor supplier and maker of infrastructure software solutions. The stock is up over 4% in 2023, but more impressive is its 30% climb the last 3 months.

Healthy institutional accumulation has likely helped vault the shares higher, which you can see below. Since November there’ve been 5 unusually large volume inflows (green bars):

Value investors may see the reasonable 12-month forward P/E of 13.8 as attractive. Additionally, a 3.2% dividend yield could be enticing.

Un lucru este sigur, acțiunile au fost la cerere în ultima vreme.

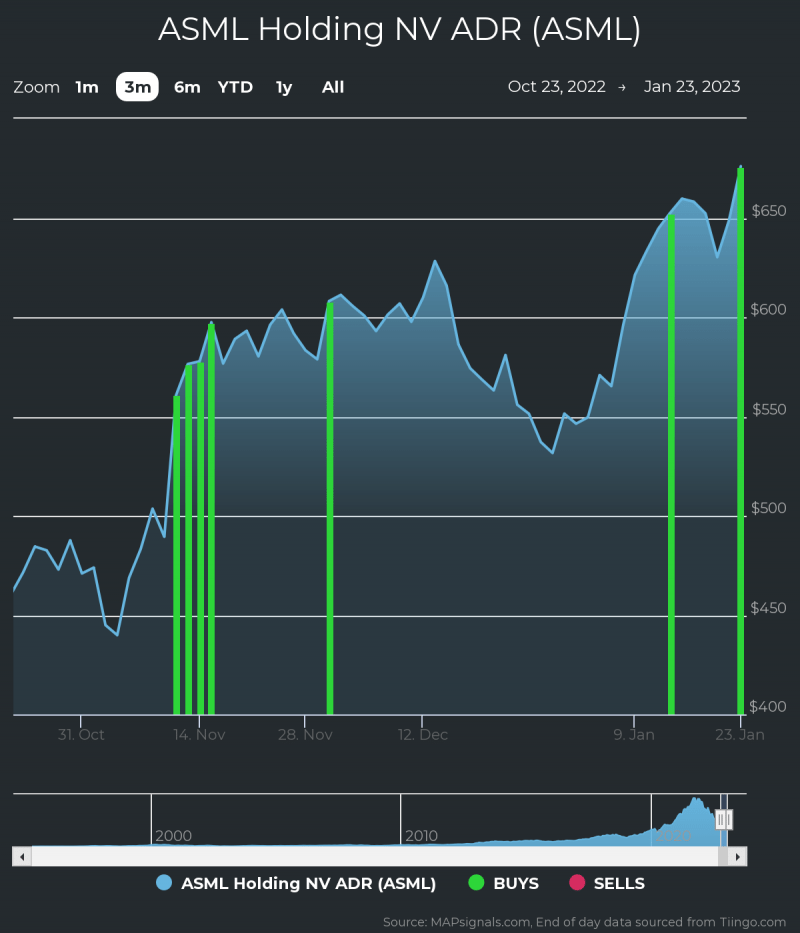

ASML Holding NV (ASML) Analysis

Următorul este ASML Holding NV (ASML) which is a large semiconductor equipment developer: including lithography, metrology, & inspection systems. The stock has jumped 23% in 2023 and over 45% the last 3 months.

Large accumulation in the shares has likely helped the uptrend. Since November there’ve been 7 days where the stock jumped in price alongside outsized volumes. That can mean there’s institutional interest:

The 12-month forward P/E is pegged at 32.4X according to FactSet. The shares pay a modest .8% dividend yield.

This price action suggests investors are expecting growth for the company in 2023.

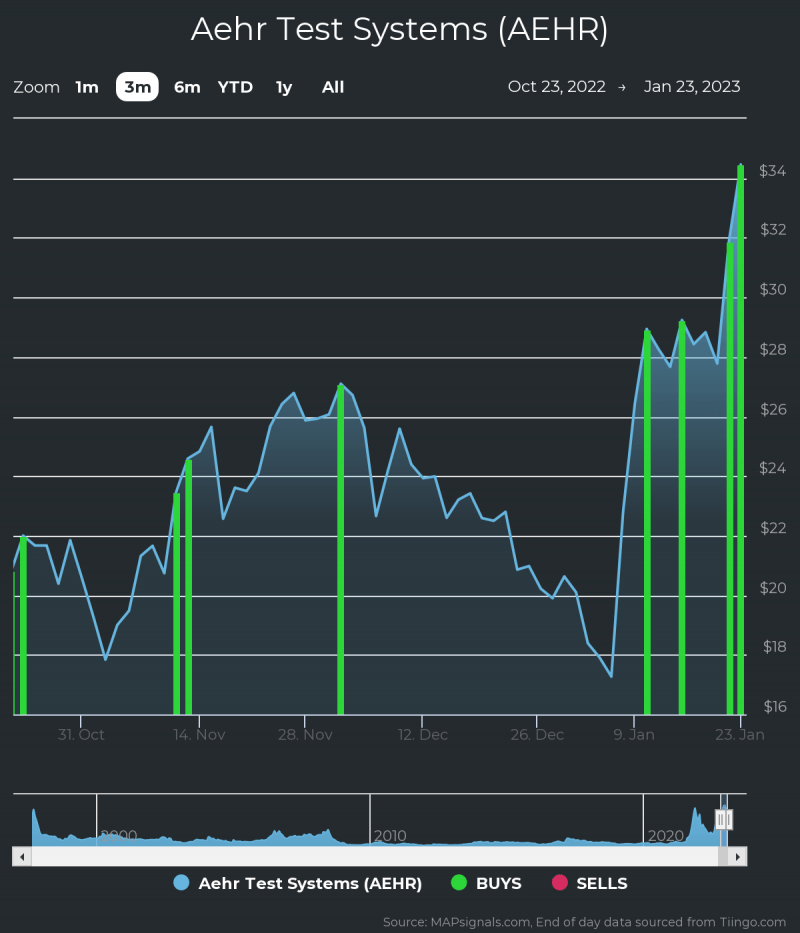

Aehr Test Systems (AEHR) Analysis

The number 3 semiconductor firm racing higher this year is Sisteme de testare Aehr (AEHR). This smaller-cap company designs and manufacturers test and burn-in products for the semiconductor industry. The market cap is just under $900 million.

The stock has been a major outperformer recently, jumping 72% in 2023. The shares have seen 9 large inflow signals since October:

There’s no question the stock could be extended at these levels. However, this is one of the most in-demand stocks according to MAPsignals research.

O conducere puternică a sectorului ar putea însemna că grupul are mai multe avantaje în 2023.

Linia de fund

AVGO, ASML, & AEHR represent 3 of the top performing semiconductor stocks so far in 2023. Healthy institutional accumulation signals make these stocks worthy of extra attention.

Pentru a afla mai multe despre procesul instituțional al MAPsignals, vă rugăm să vizitați: www.mapsignals.com

Disclosure: As of the time of this writing, the author holds no positions in AVGO, ASML or AEHR at the time of this writing.

Acest articol a fost postat inițial pe FX Empire

Mai multe de la FXEMPIRE:

Source: https://finance.yahoo.com/news/3-semiconductor-stocks-racing-higher-111743090.html