A whale removed 84,131.76 ETH from DEFI protocol Curba Finance, causing stETH to depeg to 0.9671 ETH.

The whale moved his stETH from Curve to address 0xf44Ac73b957B28207504Ee2fd5d51eCbfeF7d8fF, which now has a balance of just over 85,000 ETH.

StETH liquidation risk

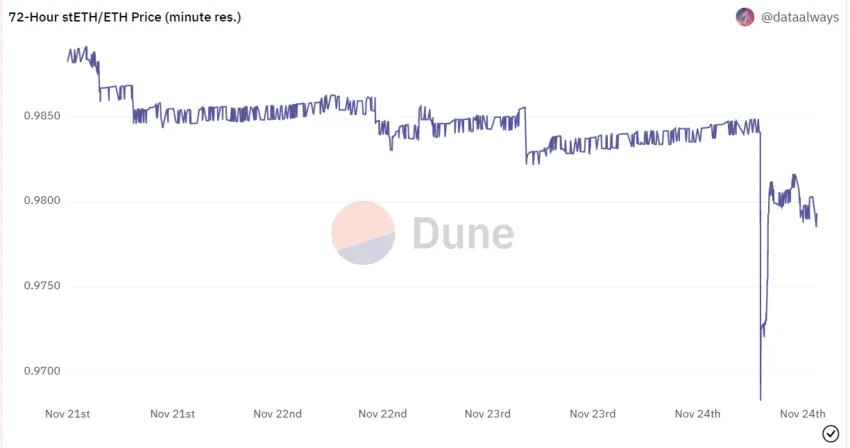

La scurt timp după retragere, the price of stETH dropped sharply to 0.9671 ETH, according to Dună Analytics, but has since recovered slightly to $0.9790 ETH. While staked ETH is supposed to be redeemable 1:1 for ETH, its price depends on the forces of supply and demand in the markets it trades in.

The depegging could concern users who plan to withdraw their stETH from the Ethereum blockchain after it undergoes the upcoming Shanghai upgrade.

Depegging can also cause severe problems for those who use the stETH as collateral for borrowing in decentralized finance. If the stETH falls below a certain threshold, the DEFI protocol can liquidate their positions.

StETH history and role and Celsius liquidity crunch

Before the Ethereum Îmbina that saw the Ethereum blockchain change from a dovada-de-muncă network to a dovada-de-miză network, users could lock up 32 ETH in the Beacon chain for a chance to become a validator and earn so-called “staking rewards.”

But smaller investors could also earn a proportion of the rewards by staking their ETH in pools like Racheta piscină or Lido. In return, the staking pool would give them stETH, essentially an IOU that the staker can redeem for 1:1 for ETH once withdrawals are enabled in the Ethereum Shanghai upgrade.

Crypto lender Celsius landed in hot water earlier this year after it borrowed customers’ ETH deposits for staking in the liquidity pool Lido. After receiving stETH, Celsius used the tokens as collateral for borrowing on DeFi lending protocol Aave.

Some users concerned that the Ethereum Merge was taking a long time to go live withdrew their ETH from Lido. These withdrawals stors ETH liquidity from Lido. The lack of liquidity made it impossible for Celsius to swap its stETH for ETH to profitably honor withdrawal requests. The company then paused withdrawals, causing the second major crypto shake-up in 2022.

When will stETH withdrawals be available?

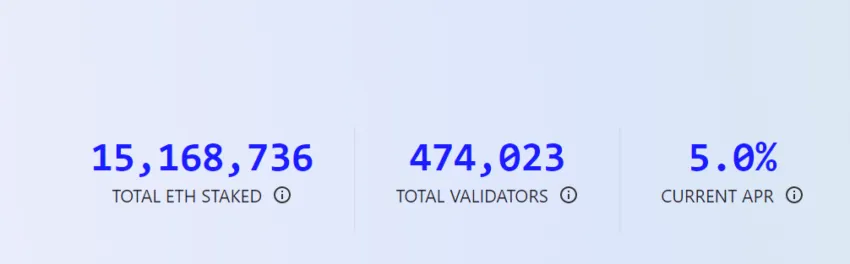

Ethereum developers launched the Beacon chain in 2020 to give enough stakers the time to lock up their ETH and become validators. Validators would secure the decentralized network after Fuziunea. According to the Ethereum Foundation, almost half a million stakers have locked over 15 million ETH.

Dezvoltatorii Ethereum sunt pregătește for the Shangdong testnet. This testnet will allow stakers to test withdrawing their staked ETH before the Shanghai hard fork.

Pentru noutățile Be[In]Crypto Bitcoin (BTC) analiza, click aici.

Declinare a responsabilităţii

Toate informațiile conținute pe site-ul nostru web sunt publicate cu bună-credință și numai în scopuri generale. Orice acțiune pe care cititorul o ia asupra informațiilor găsite pe site-ul nostru este strict pe propria răspundere.

Source: https://beincrypto.com/steth-depegs-whale-pulls-101m-eth-curve-finance/