Since crypto prices have fallen to their lowest point, now is the ideal time to “Buy-the-Dip.” But during these brief price declines, traders appear to be shorting cryptocurrency more than they are buying it.

“Buy-the-Dip” Sentiments Does Not Stop Crypto Shorting

More short sales or shorting occur in altcoins than in bitcoin. In the past day, short holdings in Bitcoin (BTC) have averaged roughly 51% across exchanges, while short positions in altcoins have averaged about 55%.

BTC/USD hovers around $20k. Source: TradingView

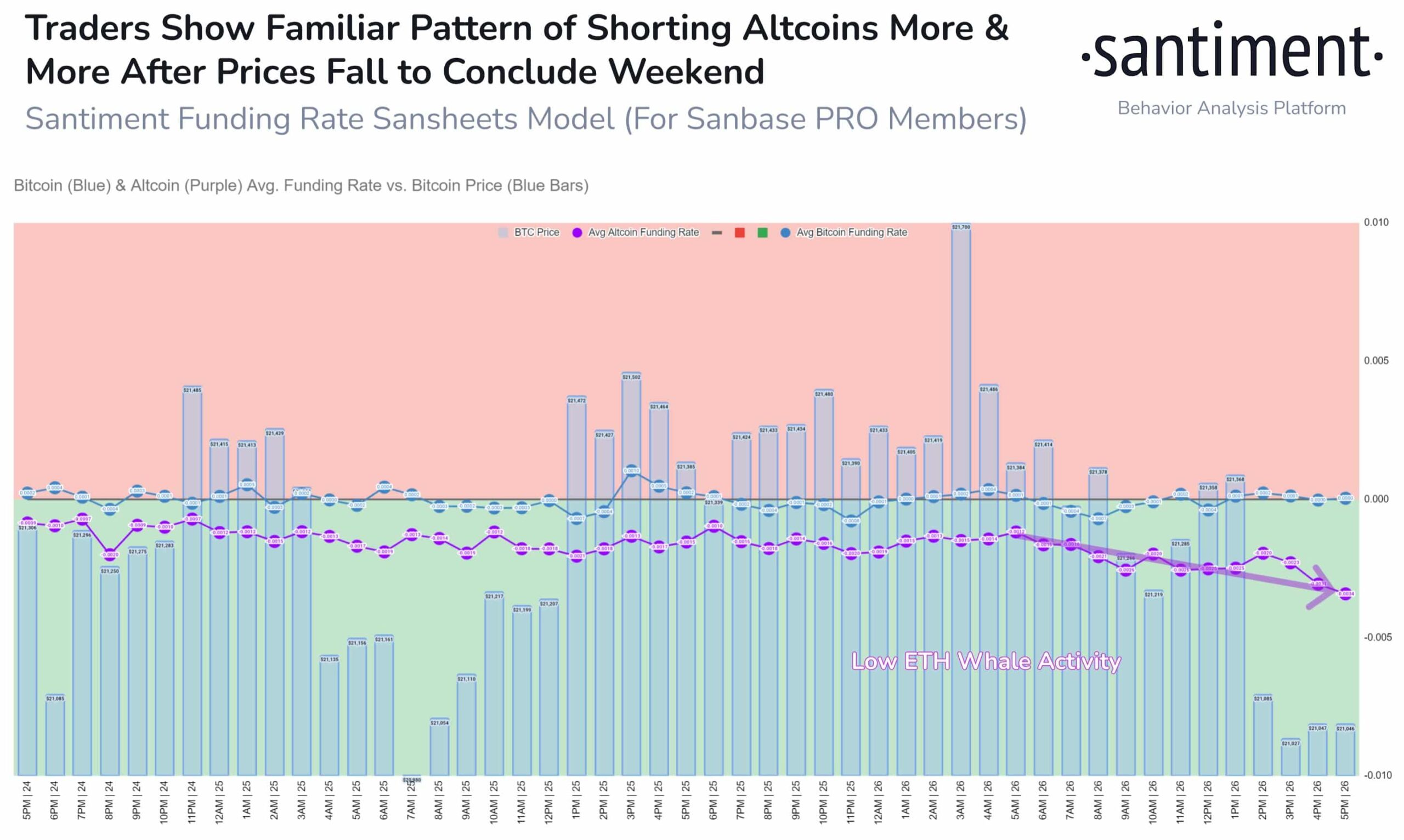

Santiment, an on-chain analytics tool, states that data on the average funding rate for Bitcoin and altcoins relative to the price of bitcoin shows that traders continue to short altcoins at every minor decline. The long/short ratio for Bitcoin, in contrast, is unchanged despite price swings.

“As prices gradually fell on Sunday, traders have shown that though they may proclaim to be buyingthedip, sunt scurtcircuitarea mai multe despre aceste mini picături. Interesant, acest lucru se aplică doar pentru altcoins chiar acum, indicând că Bitcoin is being flocked to as the safe haven.”

În conformitate cu Date Coinglass, traders kept shorting crypto on Monday. In the last 24 hours, a $25 million liquidation of Ethereum (ETH) witnessed 56 percent shorts. Polkadot (DOT), Solana (SOL), XRP, Cardano (ADA), and BNB, meanwhile, saw 55 percent, 59 percent, 63 percent, 67 percent, and 53 percent shorts.

Lectură conexă | Interesul deschis perpetuu al Bitcoin sugerează o scurtă strângere care a dus la prăbușire

Bitcoin and Altcoin Short Selling. Source: Santiment

It’s interesting to note that in the past 24 hours, short positions in Tether (USDT) have increased by 85% across exchanges. Some short sellers think that Chinese real estate brokers back the majority of Tether’s assets in commercial paper. Since the previous month, USDT has experienced significant redemptions, causing its market cap to drop close to $66 billion.

Amidst a dim market outlook, hedge funds are also progressively shorting the U.S. dollar-pegged stablecoin Tether (USDT).

Liquidation OF Altcoins Rises Amid Short Selling

Liquidations are also increasing as traders continue to short altcoins. Altcoins that were actively traded in the morning are currently in the negative. Due to a recent increase in liquidation, the price of Ethereum (ETH) has decreased by around 4% during the past 24 hours. Other altcoins have also given up gains and are currently declining.

Lectură conexă | Doom To Fail: Tether Shorts se adună în timp ce fondurile speculative caută să profite de pe urma Crypto Winter

Source: https://www.newsbtc.com/crypto/buy-the-dip-sentiment-fails-to-save-crypto-market-new-data-reveals-why/